Investing in the future: The rise of sustainable finance

Read more

Sustainability is good business

Sustainability is no longer a side issue — it’s central to long-term financial success. A growing wave of investors and companies are aligning capital with climate, equity and governance goals — not out of altruism, but because it delivers results.

The bottom line? Investing in sustainability is not just a moral choice — it’s a financial one.

The ROI of responsible investment

The numbers tell a clear story: sustainability pays.

According to a recent Morgan Stanley survey:

- 88 per cent of investors are interested in portfolios that integrate sustainability and resilience.

- 59 per cent plan to increase their sustainable investments within a year — driven by confidence in financial performance, not just social responsibility.

Why? Because sustainable investing manages risk, reduces volatility and boosts long-term value.

Stanton Chase reports:

- Solar projects generated 21–24 per cent Internal Rate of Return (IRR) over 10–25 years.

- Energy-efficient technologies cut energy consumption by 30–50 per cent, resulting in substantial cost savings.

MSCI data reinforces the trend:

- Low-carbon private investments grew 123 per cent in five years — more than double the growth rate of public markets.

- 61 per cent of investors say Environmental, Social and Governance (ESG) integration reduces investment volatility.

- 93 per cent expect climate risk to impact performance in the near term.

These are not feel-good numbers — they’re market signals showing that sustainability is a driver of value, not a cost center.

Resilience, risk management and market advantage

What makes sustainability so effective as a business strategy? It builds resilience.

Climate change, supply chain shocks and social instability are now material risks. Companies that address them proactively are better positioned to weather uncertainty and maintain performance.

Meanwhile, transparency and ESG disclosure are increasingly demanded by regulators, shareholders and consumers alike. Businesses that lead on sustainability enjoy a competitive edge: better reputations, lower capital costs, and stronger stakeholder trust.

The generational shift is driving a market revolution

Millennials and Gen Z investors are accelerating this transformation — not just in retail investing but across institutional portfolios.

The same Morgan Stanley report finds:

- 80 per cent of young investors plan to increase their sustainable investments this year.

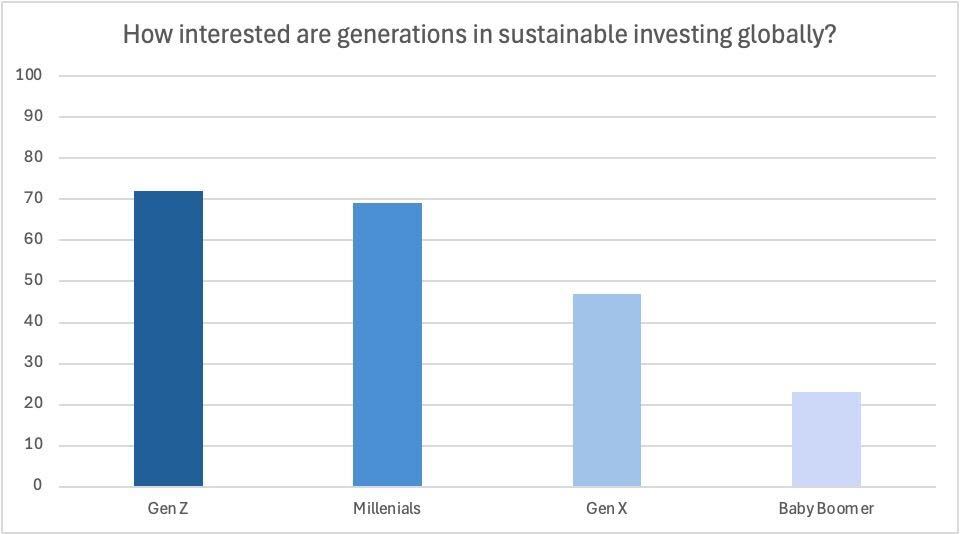

72 per cent of Gen Z and 69 per cent of Millennials are “very interested” in ESG investing, compared to much lower rates among older generations.

Source: Morgan Stanley Institute for Sustainable Investing, Sustainable Signals: Individual Investors report, 2025.

This is a signal of where the capital is heading. As this cohort builds wealth and influence, sustainability will move from expectation to a baseline requirement.

Businesses that fail to respond risk falling behind. Those that lead stand to gain customer loyalty, investor confidence and long-term market share.

A market aligned with the SDGs

Sustainable finance isn’t just reshaping portfolios — it’s reshaping markets.

Banks, insurers and asset managers are incorporating sustainability into decision-making, product design and risk assessment. They’re financing renewable energy, supporting inclusive business models and pushing for better ESG disclosure.

The message is clear: aligning with the Sustainable Development Goals (SDGs) isn’t a philanthropic gesture — it’s smart business. Sustainable investment strategies help close market gaps, unlock new growth and ensure long-term economic viability.

What businesses need to do now

To remain competitive in this evolving market, companies must:

- Embed sustainability in core operations and governance.

- Disclose transparently on ESG performance.

- Align capital allocation with SDG targets and long-term value creation.

- Collaborate with investors, regulators and peers to raise ambition.

The UN Global Compact supports businesses in doing exactly that — helping them build resilience, attract capital and thrive in a changing world.

Learn more about how to position your company for the future:

https://unglobalcompact.org/sdgs/sustainablefinance